Executive Summary (TL; DR)

Lean Portfolio Management (LPM) improves the way organizations make decisions about project and product development. This method requires a significant mindset change across the whole organization, including among business executives.

- Planning, funding, and the assessment of processes become more frequent and dynamic.

- Decisions are decentralized.

- Portfolio management extends to the entire business, not just the PMO.

In exchange for this effort, LPM aims to free your company from the constraints of the iron triangle of budget, schedule, and scope which can affect quality.

⚠️ Lean Portfolio Management isn’t without controversy, especially in large organizations. One caveat: beware of what experts describe as “the illusion of adopting agile”; often management champions this method while teams sneakily continue using traditional methodologies.

Benefits of Lean Portfolio Management

- Time to market (or time to value) improves because versions of your products can be delivered and tested earlier than under traditional predictive methodologies.

- Product fit. Because LPM is based on Minimum Viable Product iterations, the final outcome will be a better match to the demand. Also, products or services can be killed before they consume too many resources only to deliver an end result that is already outdated.

Traditional portfolio management tends to be based on long-term planning, leaving little room for manoeuvre between the initial portfolio kick-off and results. The risks are::

- Outdated outcomes

- Lack of strategic alignment

- Approval of low-value initiatives

- Overly long evaluation cycles

The company has been managing projects for a long time and outcomes have improved since the start. Project managers are generally satisfied.

Nevertheless, the project portfolio does not seem to deliver the results that business executives expect. More frequently than not, projects are finished within the expected parameters but are too late for the market. The competitive environment is changing too fast.

Despite having a strategic plan, the truth is most projects enter into a ‘dark zone’ with little oversight from the time they are approved up until the outcome is delivered. Meanwhile, new objectives and initiatives compete for scarce resources, creating tension between managers.

The overall result is not chaos, but the company feels that they fall a little further behind in industry rankings every day.

The board decides to adopt Lean Portfolio Management, expecting a more dynamic and agile response.

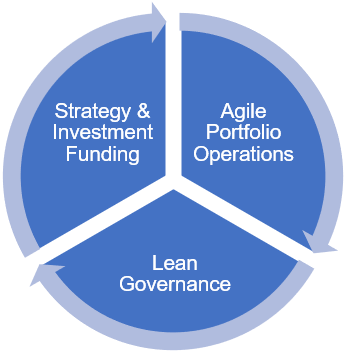

The framework

Lean Portfolio Management (LPM) is described by Scaled Agile Framework (SAFe ®as a set of organization and workflow patterns intended to guide enterprises in scaling lean and agile practices and is one of the seven disciplines a business must adopt to become an agile company (shown below). SAFe divides all company activities into two main blocks: execution and strategy.

You may wonder whether you need to implement all seven core competencies of the lean enterprise to implement LPM.

Read on.

Must haves before starting

Lean Portfolio Management implementation requires:

- A directive from the board. The PMO shouldn’t try to implement LPM alone without an explicit mandate. The PMO can advocate for it, but because the changes required are so significant, top-level executives should take the lead.

- Business executives' involvement is crucial. LPM involves intensive tracking, evaluation and interaction between business and portfolio managers.

Make sure your company understands and accepts all these needs. Otherwise, lean portfolio management can lead to frustration.

You don't necessarily have to have all the seven core competencies fully rooted in your organization to implement LPM. But, as you will see, lean portfolio management is not just a framework or a way to do things differently. It requires a change of mindset, especially in management areas.

Value Stream

The value stream is the sequence of steps used to deliver value to the customer. It contains the people, the systems, and the flow of information involved in delivering that value.

This value stream is for ‘Routine admission laboratory testing for general medical patients’.

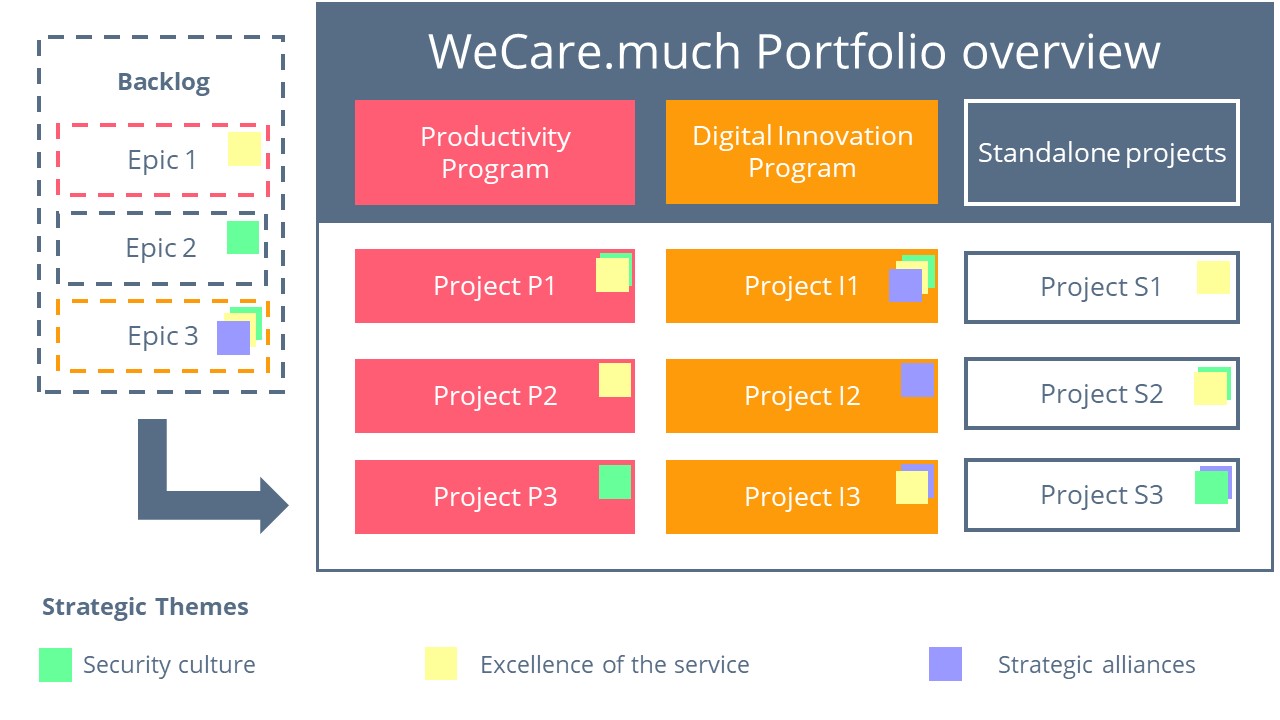

Lean portfolio management defines a SAFe portfolio as a collection of value streams for a specific business domain.

Decentralization

Decentralization is becoming prominent (cryptocurrencies, smart contracts, and decentralized applications are good examples). Portfolio management is no exception.

Where ‘lean’ takes advantage of the benefits of decentralization in general, Lean Portfolio Management in particular, takes advantage of the following:

- Dynamic demand management

- Decentralized decision-making

- Self-managed value streams.

⚠️ On the flip side, some organizations experience difficulties in achieving true decentralization. Stakeholders have a hard time giving away control to project teams, regarding them as more focused on their specialism than acquiring knowledge of the client and the industry.

This has led to some companies reverting to centralization and reinforcing their PMOs.

Long-term planning. Epics

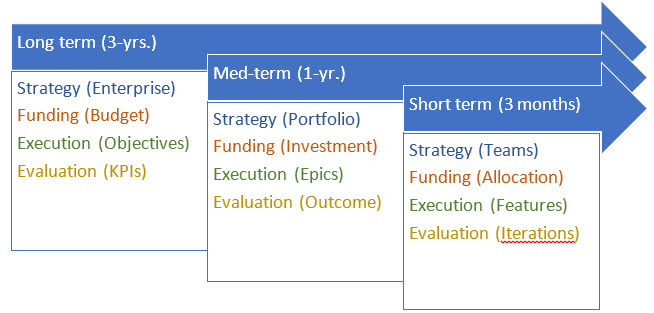

LPM is not about improvisation, neither from a business or a portfolio point of view. It requires a solid plan based on the business strategy, typically covering a three-year-long horizon.

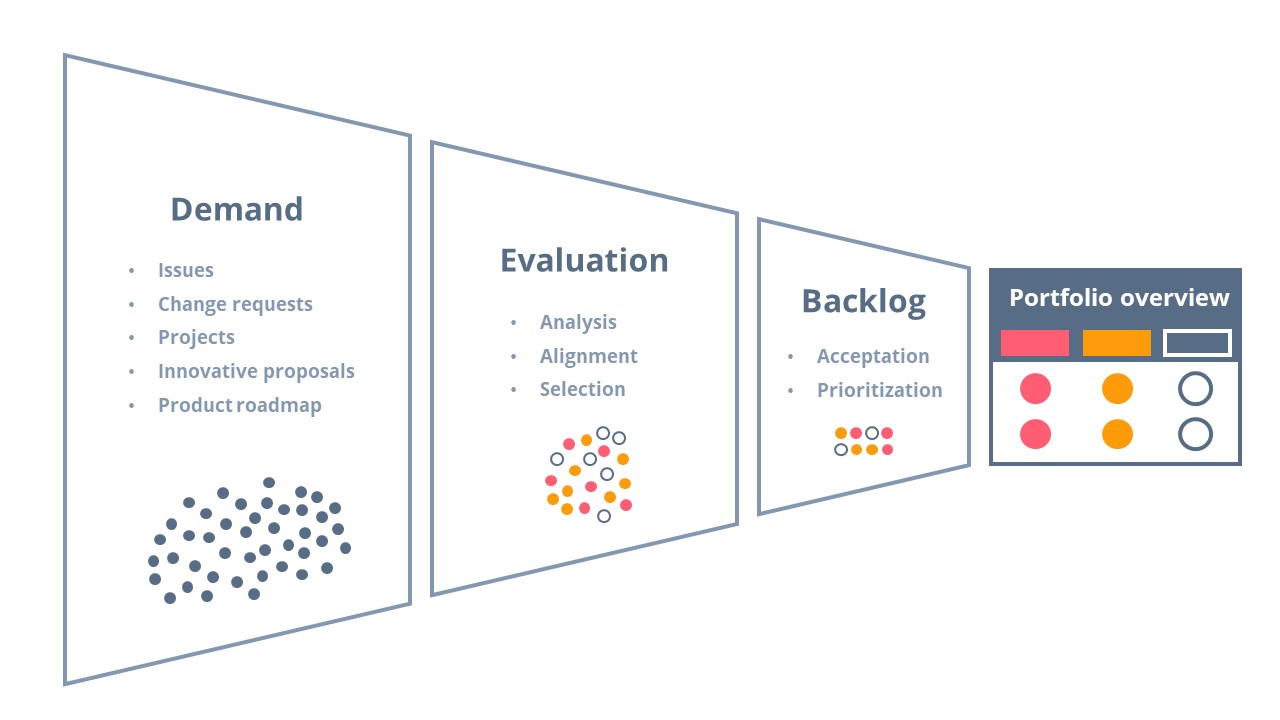

Lean Portfolio Management suggests building a backlog based on Epics (high-level user-language description of features), then moving to the live portfolio and its programs.

Shorter plans

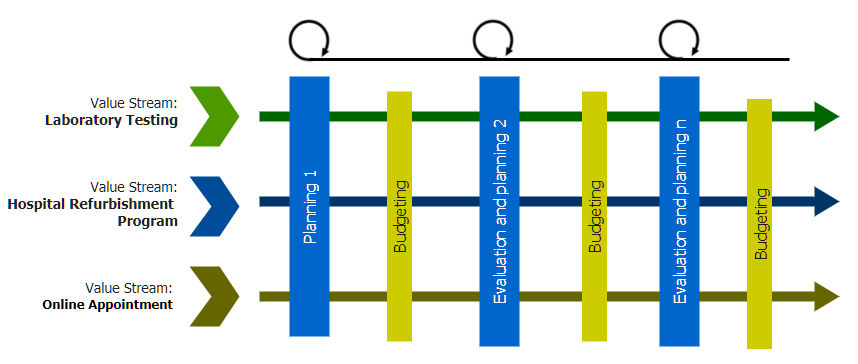

Once you have a three-year plan, break down that strategy into smaller periods, typically years. Then break them down again into quarters.

You can then plan and allocate resources to activities that happen in those quarters.

Each cycle will be individually funded, executed, and assessed.

After adopting Lean Portfolio Management, long-term plans were broken down into more manageable activities. Resource and funding allocation for those activities turned out not only to be more manageable but also more accurate.

Also, outcomes are more closely assessed to ensure they bring the expected value to the company.

We now have the funding and governance mechanisms to supply a consistent set of resources to activities.

Funding

Funding must match the planning schedule.

We discussed how planning is divided into long, medium, and short-term plans. Budgeting must match each of those plans with three-year, one-year, and quarterly funding budgets.

Minimum Viable Product

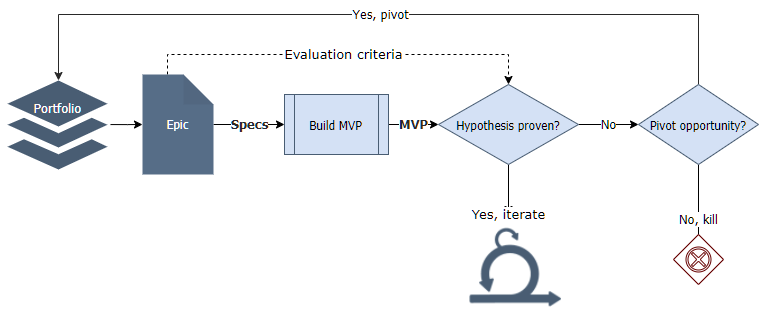

For each outcome, Lean Portfolio Management suggests using the Minimum Viable Product (MVP) concept, which is the cornerstone of any lean-approach.

An MVP is a version of a new product that allows your team to collect the maximum amount of validated learning about customers with the least effort.

This concept limits upfront commitments seen in the traditional predictive models and focuses on allocating resources to develop a Minimum viable product.

Once the MVP is available, you will need to evaluate the outcome and verify if it matches the hypothesis. You can then decide whether that project is worth pursuing, pivoting, or killing altogether.

Pivot, persist or kill

One of the most complex decisions takes place during the MVP evaluation process. Companies struggle at this stage since it is human nature to persist rather than admit we were wrong.

To perform an objective evaluation, it is crucial to have a clear hypothesis and straightforward criteria of what is expected from the MVP before the MVP is built. So the team can match expectations with results in a dispassionate fashion.

• Whether the MVP meets the initial criteria. Is the value delivered as expected?

• Make sure the team appreciate what the sunk cost is but disregard it in decision-making.

Opportunity assessment (spontaneous initiatives)

The opportunity assessment process tells us whether unplanned initiatives may have more value than others currently being developed.

Lean portfolio management should explore those ideas, explain them to the business managers, and give them the tools to prioritize (or even replace) current initiatives with those that add more value to the company.

To ensure the balance between these initiatives and the long-term plan, there is the concept of budget guardrails, which will ensure that:

• the strategic vision is adequately funded

• capacity is allocated in the most efficient possible way

• new initiatives are assessed before being approved

Meetings, meetings

As we have stressed, Lean Portfolio Management stands out because its requirement for frequent and efficient communication between teams.

One of the main tools is quarterly demand-delivery meetings.

These meetings seek to achieve two main goals:

- The demand – usually enterprise managers – explains what is needed and why it is needed.

- Delivery managers and portfolio managers assess whether they have the capacity or if there are any roadblocks to execution.

Waterfall-based projects within a Lean Portfolio Management organization

Can we have waterfall projects within a Lean Portfolio Management approach? Of course!

When we run projects with a well-known sequence of activities, waterfall-based projects make sense and coexist with agile-based projects.

Deep connection between the parts

There is a deep, intimate connection between the enterprise and its finances with portfolio management.

We shouldn’t expect to have perfect knowledge or predict everything that will happen until we reach our objective. We need to have enough information and detail to iterate and re-evaluate along the process.

In the same way, we don't need to have a fixed budget. We need a budget for the entire vision and then evaluate the financial needs that we have as we go.

This is why it is essential to have business managers that understand the financials to prioritize what's more important and what can be done with the available funds.

Similarly, the resources at our disposal can be allocated more dynamically. Managers don't need to allocate entire departments to a single function anymore. Instead, they will be allocating resources to those projects at the moment in time when they are more necessary.

⚠️ Caveats and challenges

We’ve pointed out some of the arguments against implementing SAFe's Lean Portfolio Management to give you the whole picture. To sum up these are::

• It is designed as a one-size-fits-all.

• Very consultant-dependent and certification-eager.

• Not used in big software organizations (Google, Facebook, Microsoft, Netflix, etc.)

• Stressful for stakeholders and teams, who find their ways around.

• In practice, an absence of the customer's voice

• Against Agile Manifesto's first tenet: "Individual and Interactions over Processes and Tools."

For more challenging view points read Jeff Gothelf's article, SAFe is not Agile, Marty Cagan's article Revenge of the PMO, or Steve Denning's article, Understanding Fake Agile

Lean Portfolio Management Assessment

To have an independent view as to whether Lean Portfolio Management works for your company, you need to go back to the main goals we pointed out to implement LPM in the first place.

- Has the time to market improved?

- Has the market fit improved?

You may also want to assess the cost of implementing LPM.

- Is there any increase in defects?

- Has productivity improved?

- Has employee satisfaction been affected?

- Do the benefits outweigh the cost?

The answer to these questions will give you the feedback you need to spot areas for improvement. They also help you assess whether Lean Portfolio Management is for you.

How does ITM Platform enable Lean Portfolio Management?

Lean Portfolio Management is not about the set of tools but rather about the processes, mindset, and actions that make it possible. Nevertheless, key aspects require data aggregation, visibility, and transparency that would be hard to attain without the right tools.

These are some of the high-level features you will find helpful:

• Strategy: value-based epic prioritization.

• Portfolio: Initiative global view

• Budgeting and controlling: allocate resources and funds. Control usage.

• Work Management: Plan, assign and follow progress in real time.

Takeaways

We have covered the most relevant aspects of a Lean Portfolio Management implementation. These are the highlights:

- LPM can improve your time-to-market and product fit.

- LPM is demanding. Make sure your organization understands and accepts the challenge.

- Get the most robust possible sponsorship.

- LPM is part of a larger framework. Figure out which parts of the big picture you need to implement along with LPM.

- Understand and work out the flipside. LMP may not be for your organization

- Map the value streams.

- Decentralization is king. But hard to achieve.

- Plan long-term with Epics and organize a streamlined portfolio.

- Break down long-term plans in quarterly activities.

- Fund and allocate resources to short-term activities.

- Develop Minimum viable products.

- Be objective when evaluating MPV's outcomes, and pivot when necessary.

- Make room to assess new opportunities and ideas.

- Set budget guardrails to ensure new ideas fit in the big picture.

- Encourage demand-delivery managers' interactions.

- Encourage demand-delivery managers' interactions.

- Measure the benefits of Lean Portfolio Management to enable a continuous improvement system.