It’s surprising then, that revenue recognition, the process by which businesses decide which transactions qualify as revenue, is not generally understood outside accounts departments. Cash doesn’t count as revenue until you’ve earned every single penny of it. This is especially true in industries such as consulting and construction, which typically involve long, complex projects.

This is why revenue recognition should be on the radar of PMOs and project managers, as well as CFOs. What’s the point of bringing in a project on budget and on time, if we aren’t keeping track of the revenue that it’s adding to our books?

While there are numerous methods for recognizing revenue, we’re going to cover the most common ones, giving pointers on how to choose the right one for your project. Read on to learn more about the following:

- What is revenue recognition?

- The difference between cash flow and revenue

- 5 golden rules that set the standard for revenue recognition

- Methods for calculating revenue recognition

What is revenue recognition?

With long-term projects or those involving B2B, the structure of payments can be tricky. Should the client pay upfront, in the middle of the project or when all deliverables have been received? The answer to this question lies in the generally accepted accounting principle (GAAP) of revenue recognition, which holds that we only count revenue once the money has actually been earned.

Payment on provision of service

In day-to-day life billing is a fairly straightforward affair. Let’s say a customer tries out a fashionable new restaurant; she’s served a delicious meal and happily pays up. This is what we call payment immediately on provision of service. Our restauranteur can record the revenue.

Payment before service

Now imagine the customer is so delighted with the meal that she decides to celebrate her 40th birthday in the same establishment, six months from now. This time it will be a blow out affair, with a guest list of 60 well-wishers. Planning to close off a large section just for her, the restaurant asks for payment before the party. This is what we call deferred revenue. We won’t record it as revenue until the cash has been earned, that is when the birthday girl is blowing out the candles on the cake.

Payment after service

In another scenario, the happy customer recommends the restaurant as caterers for her workplace’s corporate entertaining. The company can order a fully catered meal any time they have guests and pay on account at the end of each month. This is accrued revenue. The restaurant can record the cash as earned from a meal served on the 1st – even if they don’t get paid till the 30th.

For a PPM tool with integrated revenue recognition, trust ITM Platform. Start your free trial today.

Cash flow and revenue are different

The most important principle to understand here is that cash and revenue aren’t the same thing. Just because the cash is in the bank doesn’t mean that we can recognize it. If the buyer cancels the order or the goods or services are not delivered, we can refund them.

This principle becomes even more important in situations involving complex projects. Different industries use different models to calculate revenue recognition. Before we look at these various methods, it’s worth understanding the basic framework which underpins any contract based on revenue recognition.

5 golden rules of revenue recognition

Before work starts, an organization can decide which transactions count as revenue using globally accepted standards. In line with this international framework you must:

- Draw up a contract with the customer.

- Identify contractual performance obligations (those pesky promises made by the sales team).

- Determine the transaction price.

- Link the transaction price to the contractual obligations (define the point at which the client will hand over the cash).

- Recognize revenue when the performing party satisfies the performance obligation.

What these five steps mean is that you need to have a contract with a customer, a product or service to deliver, clear pricing, and delivery terms. When the delivery terms are met, you can recognize the revenue.

Methods for calculating revenue recognition

Now it’s time to see how this works in practice with some examples.

Percentage-of-completion

Using this method, we calculate revenue recognition by multiplying the progress of the project during set periods by the total revenue budget. Complete 10% of the project and you can recognize 10% of the revenue. Periods are typically monthly, quarterly or by trimester.

Example: The railway

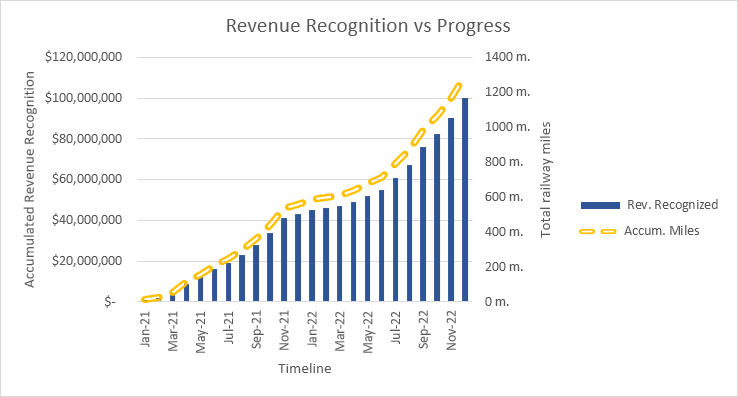

Your company, Silver Railway, wins a two-year contract to build a 1,300-mile railway. The total budget is $100 million, invoiced in eight separate equal payments every quarter.

Silver Railway warns the client that progress won’t be the same every month. The number of miles you can build each month will depend on the difficulty of the terrain, whether you have to build a station along the way and so on.

So, let's now see how revenue recognition and progress unfold over time.

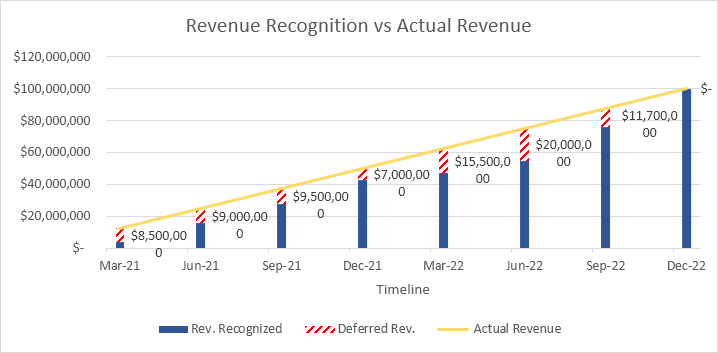

Now, let's compare revenue recognition with the actual revenue (when you invoice the client).

Linear Distribution by Milestones

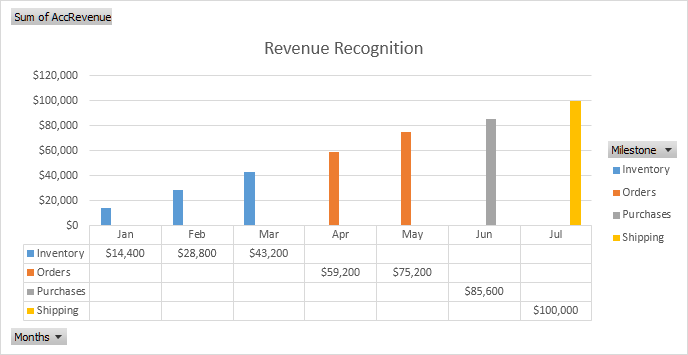

Next, let’s turn to revenue milestones. The value of each milestone is the proportion of estimated hours needed to perform it, multiplied by the total revenue budget. Unlike the percentage-of-completion approach, the pace of progress isn’t the key factor. What matters is hitting the milestones.

Example: The software project

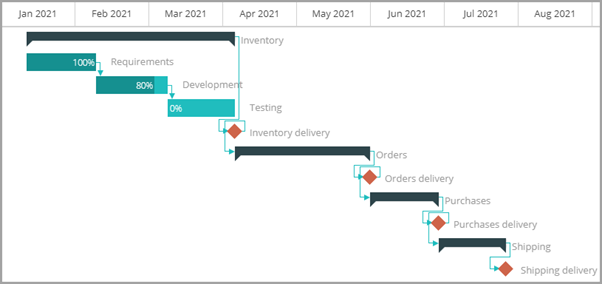

You’re developing a medium-sized software for a retail company, Rain Forest, which includes four modules: Inventory, Orders, Purchasing, and Shipping. The total revenue budget is $100,000, with an estimated delivery time of six months for all four modules.

Payments are agreed as follows: 30% at the beginning, 30% after the order module is done – estimated by the third month – and 40% at the end.

You opt for the milestones method, assigning each module to a milestone, knowing that the two first milestones are more labor intensive than the last two.

Now let’s track the revenue recognition and cash flow.

Fixed Price per Period

This is the simplest method because it divides the total revenue budget by the number of periods within the project, applying the same revenue recognition amount per period.

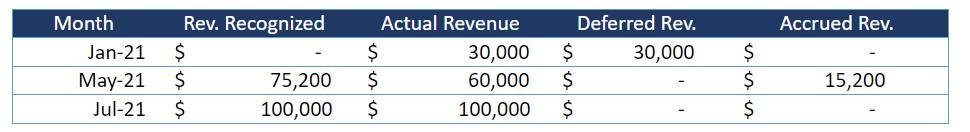

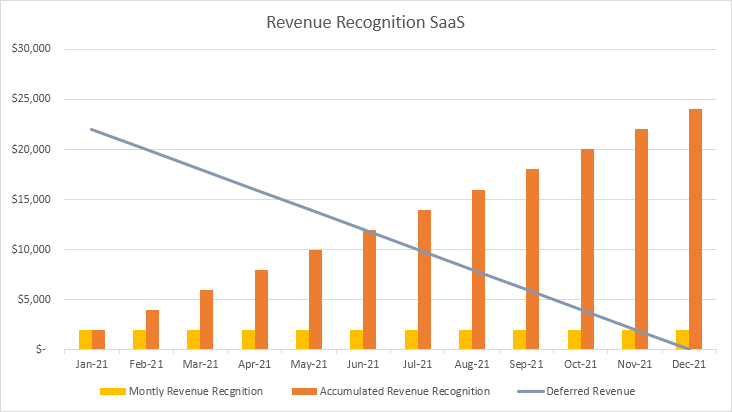

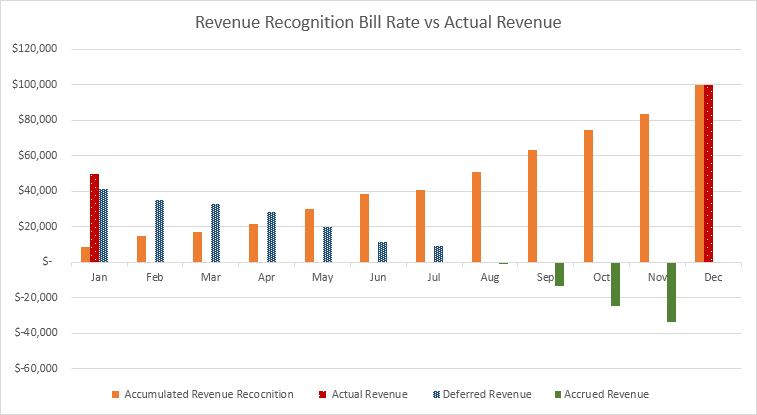

Example: Software as a Service

Your company, Sales Muscle, develops and distributes software as a service (SaaS) using a yearly subscription. Clients pay 12 months upfront (deferred revenue).

Under the fixed price per period model Sales Muscle has the money sitting in the bank, even though it has yet to earn it. If the customer cancels the service during the year or has any complaints, you can refund them using the remaining balance.

You’ll recognize the same amount each month until you reach the end of the year when all deferred revenue is finally recognized.

For a PPM tool with integrated revenue recognition, trust ITM Platform. Start your free trial today.

Bill rate per estimated hours

Here you multiply the bill rate per professional category by the estimated hours of each task, by the progress made per period (Rate x Estimated hours x Progress). The beauty of this approach is that you can bill customers the estimated – rather than actual – hours.

Example: The professional services

Your consultancy company, The Fifth Big, has bagged a significant contract to transform the financial processes of a big client.

Because hours are the driver of costs and revenues, The Fifth Big uses the bill rate per estimated hours method.

Direct Revenue Recognition

This method recognizes all revenue, regardless of status.

Example: The reseller service

Your company, SureStart, runs value-added projects for clients, but some of your clients want to centralize the acquisition of goods and services, such as software licenses and small acquisitions, through yours.

Every month, your client tells SureStart which goods and services they require, so you apply the direct revenue recognition method to recognize revenue as it happens.

Conclusion

With so many PMOs adopting the revenue recognition approach, it’s not a case of one size fits all. Our brief overview has revealed the many different methods available across industries. Whichever you settle on, there’s no doubt that tracking every penny of income has never been more important.

You can’t spend on salaries, record profits or invest without a good idea of what’s actually yours to spend. The rewards for understanding and applying revenue recognition criteria to projects are not just greater financial control but also the ability to embed your project management practice into the overall business strategy. And the PMOs who get that will strengthen the long-term resilience of their companies.